japan corporate tax rate 2020

KPMGs corporate tax rates table provides a view of corporate tax rates around the world. Medium-Small sized company for tax benefits lower reduced tax rate carry over losses NOL net operating loss and carry back of losses.

Corporate Tax Reform In The Wake Of The Pandemic Itep

On 10 December 2020 Japans coalition leading parties released the 2021 tax reform outline the Outline.

. Historical corporate tax rate data. Diversity Equity Inclusion at Deloitte Japan. Japan corporate tax rate 2020.

A tax reform bill the Bill will be prepared based on the Outline. Taxation in Japan 2020. Starting a business in Japan.

Revision of the consolidated taxation. The surtax rate of 21 is applied to the amount of national income tax. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law.

The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark. Film royalties are taxed at 15. Corporate Tax Rate in Japan averaged 4083 percent from.

81 3 6229 8000 fax. The corporate income tax is a tax on the profits of corporations. 81 3 6229 8000 fax.

Learn the essentials of Japans corporate tax rates and your obligations as an employer in Japan with Links International. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. This Alert summarizes the key provisions relevant to multinational.

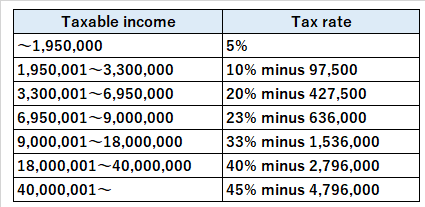

Japan corporate tax rate 2020. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by. As a result the effective tax rate for the highest bracket was 45945 for 2020.

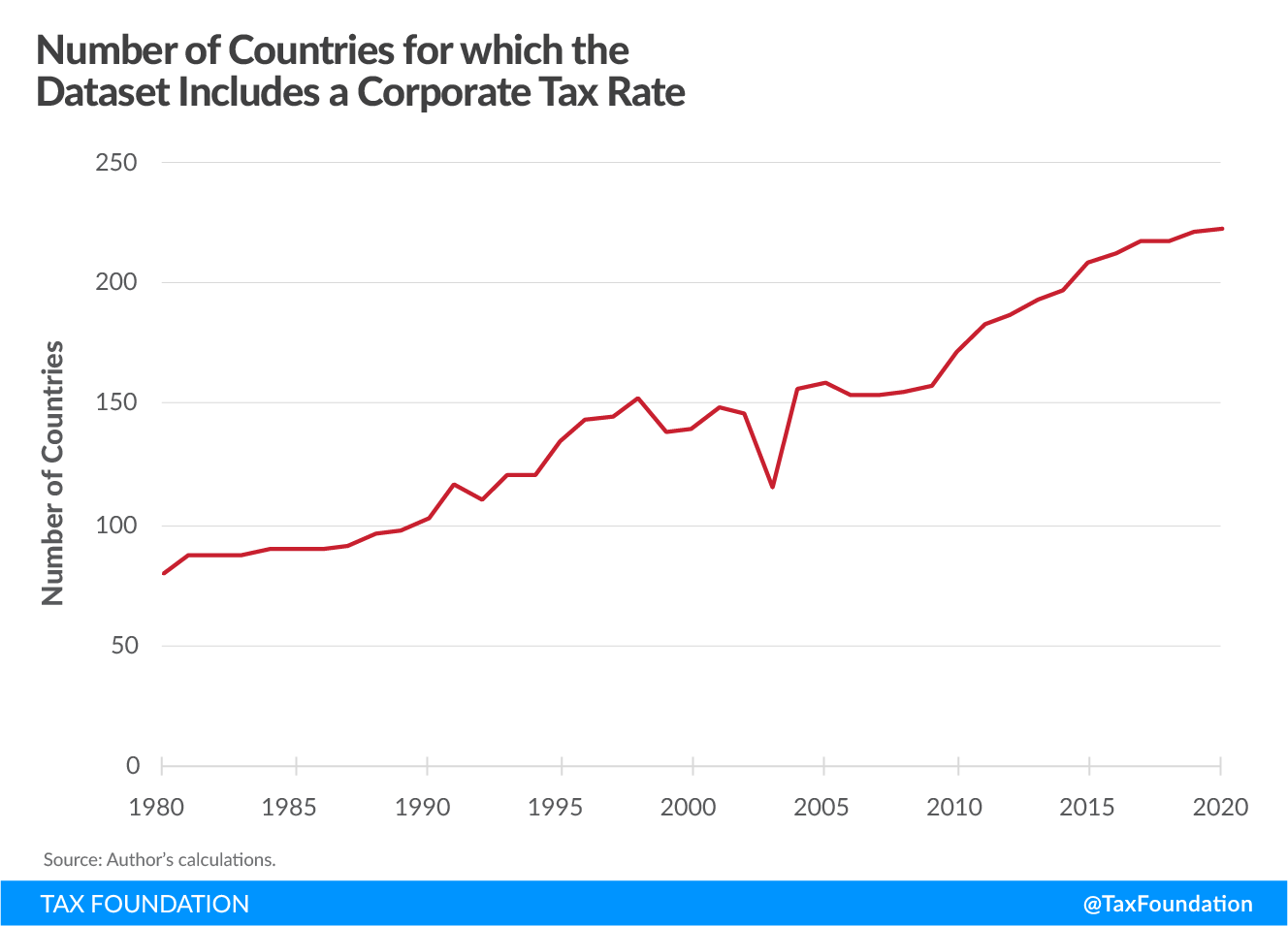

13 February 2020 Japan tax newsletter Ernst Young Tax Co. The tax rates applied to profit and loss sharing groups will be. 225 rows One hundred of the 223 separate jurisdictions surveyed for the year 2020 have corporate tax rates below 25 percent and 117 have tax rates above 20 and at or below 30 percent.

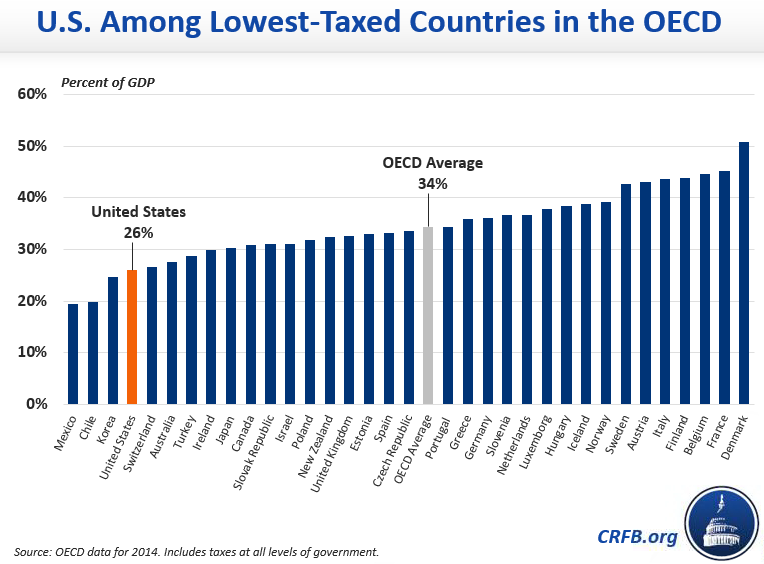

Effective corporation tax rate including local tax in Japan. Costs and the applied effective tax rate of corporate taxpayers. The United States has the 85 th highest corporate tax rate with a combined statutory rate of 2577 percent.

National Health Insurance Rate. Employee Social Insurance Contribution Rate. February 7 2020.

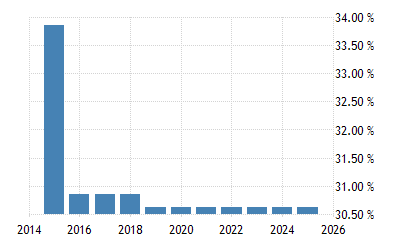

Guidance for Taxpayers on the Mutual Agreement Procedure QA PDF386KB Japans Tax Conventions Including MAP Provisions as of Jan 1 2018 PDF120KB Information for Taxpayers. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. 2020 Japan tax reform outline.

Choose a specific income tax year to see the Japan income tax rates and personal allowances used in the associated income tax calculator for the same tax year. The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy. Data published Yearly by National Tax Agency.

Corporate Tax Rate in Japan remained unchanged at 3062 in 2021. Local management is not required. Our company registration advisors in Japan can deliver more details related to the corporate tax in this country.

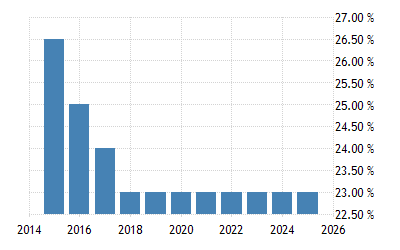

The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. The average tax rate among the 223 jurisdictions is 2257 percent. Corporate tax rate in japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

The Bill will be submitted to the Diet 1 and is expected to be enacted by the end of March 2021. Japan Highlights 2020 Page 2 of 10 Rate The national standard corporation tax rate of 232 applies to ordinary corporations with share capital exceeding JPY 100 million. The corporate tax rate in Japan for a branch is the same as for a subsidiary.

GIG is a specialist group established to respond to the various needs of foreign companies developing business in Japan. Tax rates for corporate income tax including historic rates and domestic withholding tax for more than 170 countries worldwide. In case the financial year end is 31 Dec 2020 final tax.

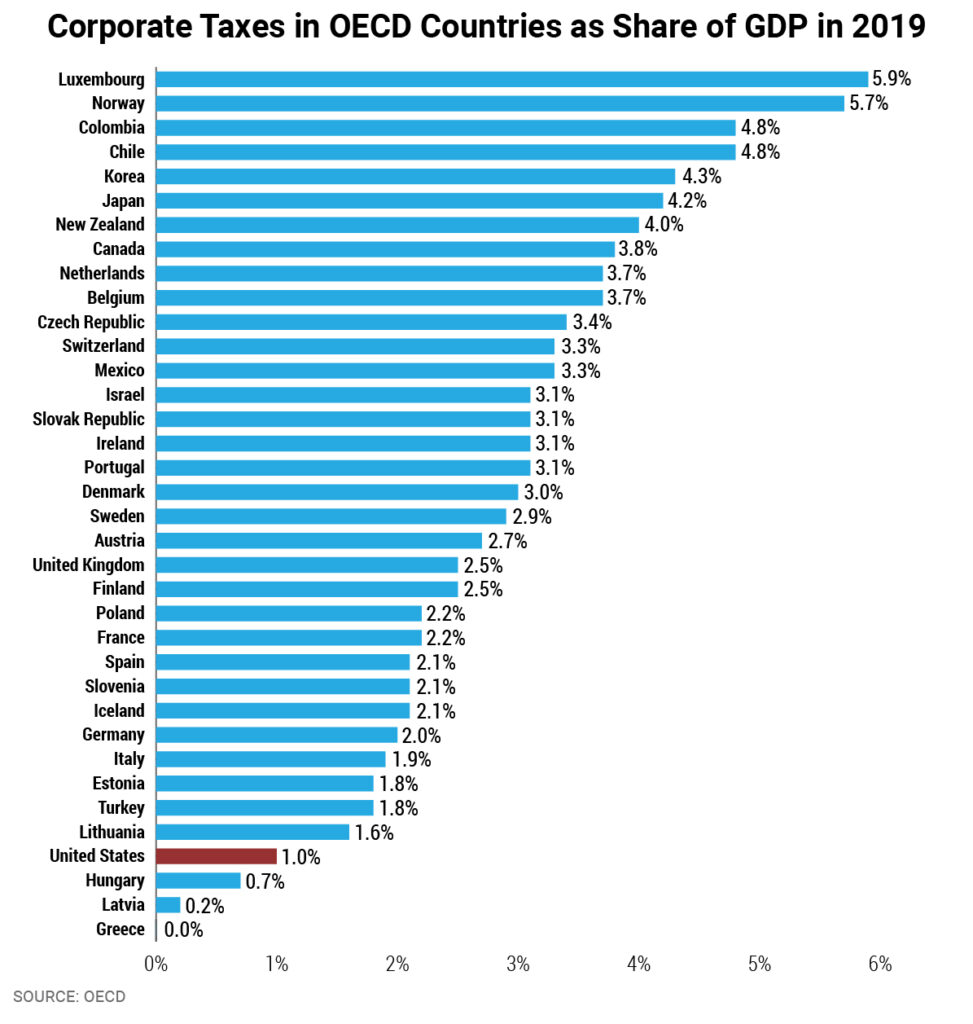

All OECD countries levy a tax on corporate profits but the rates and bases vary widely from country to country. National Tax Agency Report 2021 PDF156MB Mutual Agreement Procedures Report 2018 PDF307KB Publication. Companies also must pay local inhabitants tax which varies with the location and size of the firm.

2 Japan tax newsletter 13 February 2020 Corporate taxation 1. Comparing Europes Tax Systems. The latest comprehensive information for - Japan Corporate Tax Rate - including latest news historical data table charts and more.

Employer Social Insurance Contribution Rate. While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is recommended that specific advice be taken as to the tax. Corporate Tax Rates around the World 2020.

Data is also available for. The maximum rate was 524 and minimum was 3062. 推薦指數 30 10.

What is Corporate Tax Rate in Japan. Local inhabitant tax consists of prefectural tax a flat rate of 4 plus 1500 of per capita levy and municipal tax a flat rate of 6 plus 3500 of per capita levy. Corporate Taxation in Japan.

Canada Tax Income Taxes In Canada Tax Foundation

Canada Tax Income Taxes In Canada Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

What Is A Global Minimum Coporate Tax And How Would It Work World Economic Forum

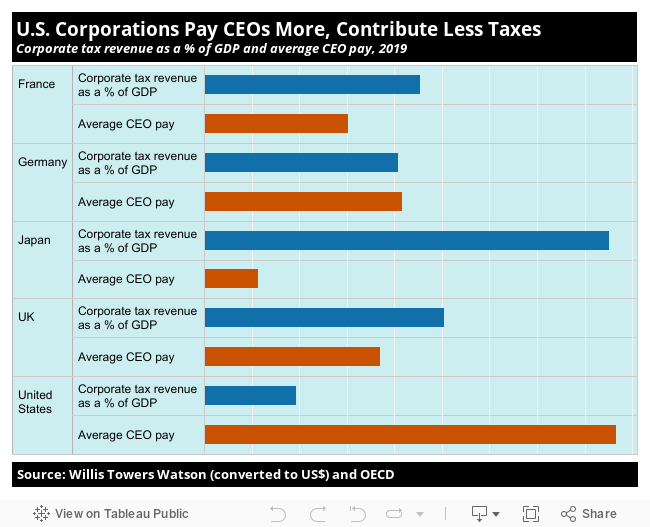

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Real Estate Related Taxes And Fees In Japan

Malta Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

Real Estate Related Taxes And Fees In Japan

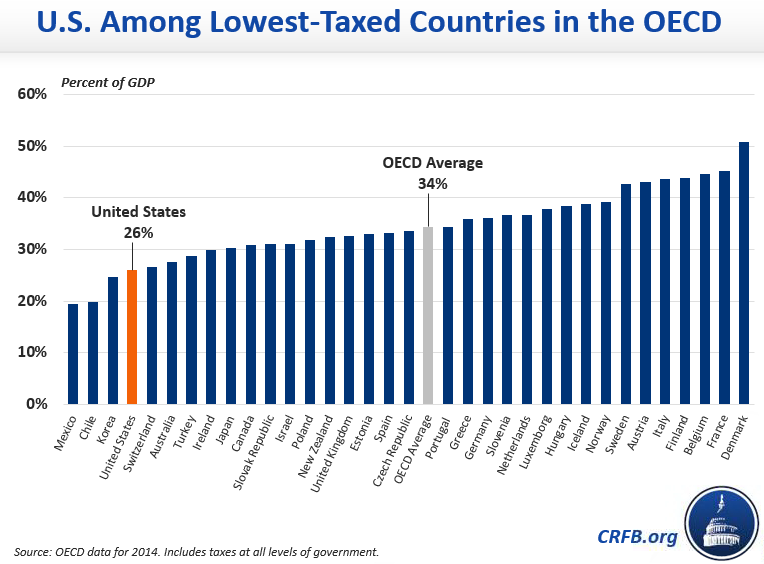

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Canada Tax Income Taxes In Canada Tax Foundation

Real Estate Related Taxes And Fees In Japan

Real Estate Related Taxes And Fees In Japan

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

What Is A Global Minimum Coporate Tax And How Would It Work World Economic Forum